Plataforma de financiación y M&A para proyectos de energía renovable

Alter5 ofrece a promotores soluciones de financiación y compraventa para proyectos en desarrollo, construcción y operación

300MW+

En financiación

EUR 300MM

Volumen de inversión

2.000MM +

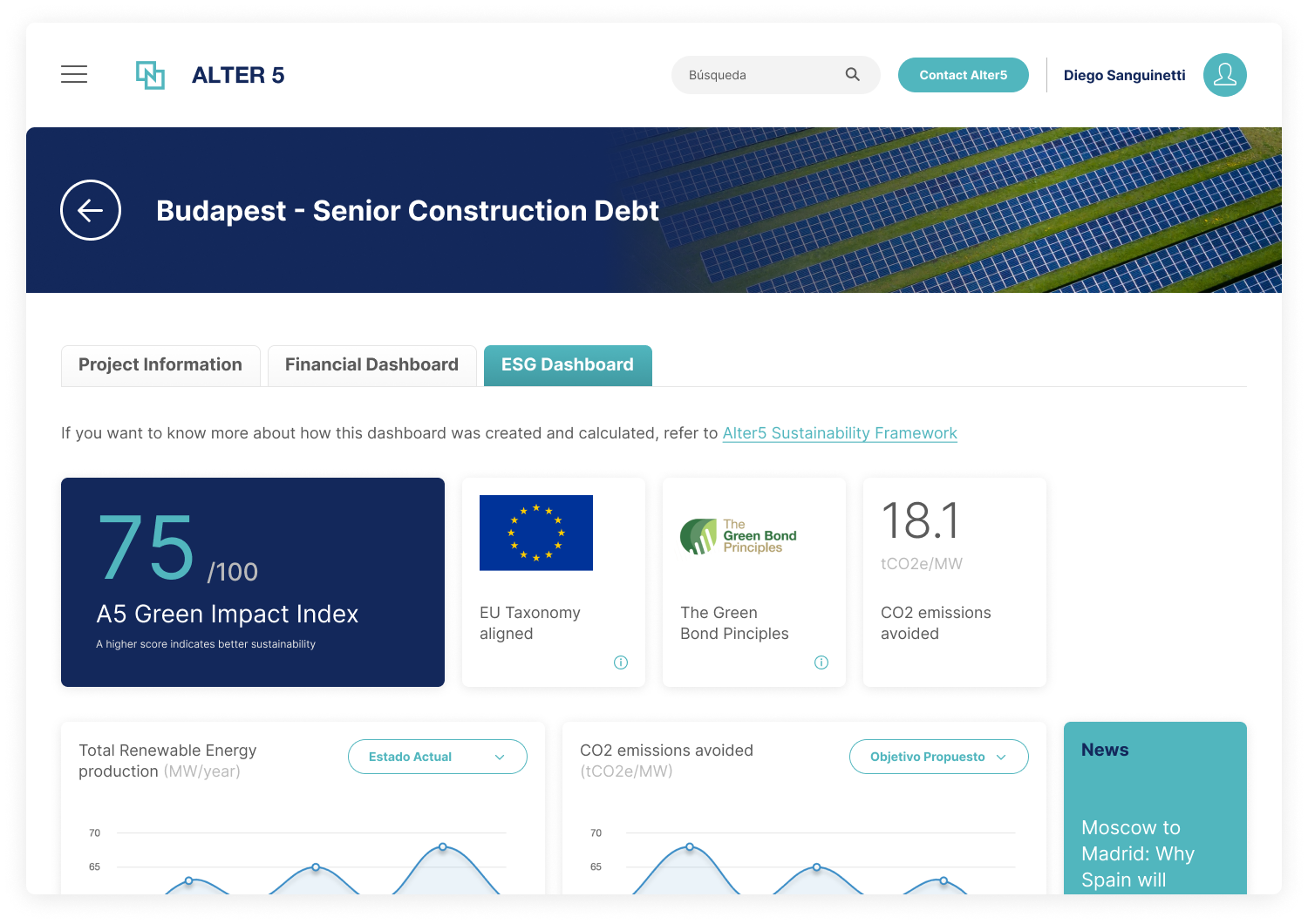

tn equivalentes evitadas de CO2

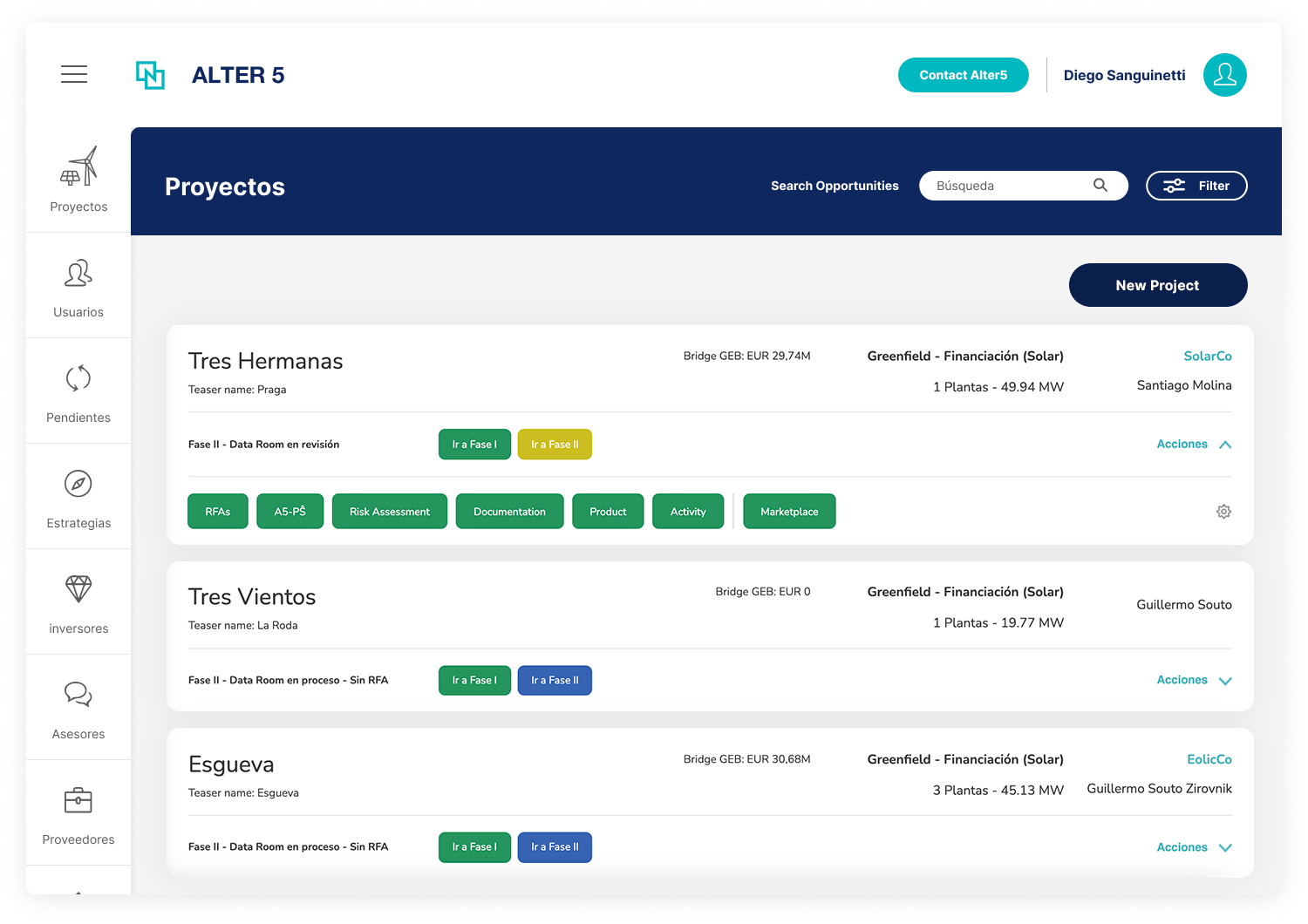

Una plataforma que facilita a promotores nuevas fuentes de financiación y acceso a mercados de capitales

Mediante una plataforma digital diseñada con expertos de la industria, Alter5 simplifica los procesos de validación y análisis de los proyectos, acelerando los procesos de financiación y ofreciendo a los promotores productos y servicios según la fase de desarrollo en la que se encuentre el proyecto.

Alter5 colabora con el Fondo Europeo de Inversiones en el diseño de estas soluciones de financiación, permitiendo a los promotores acceder a condiciones de financiación competitivas para sus proyectos.

Promotores

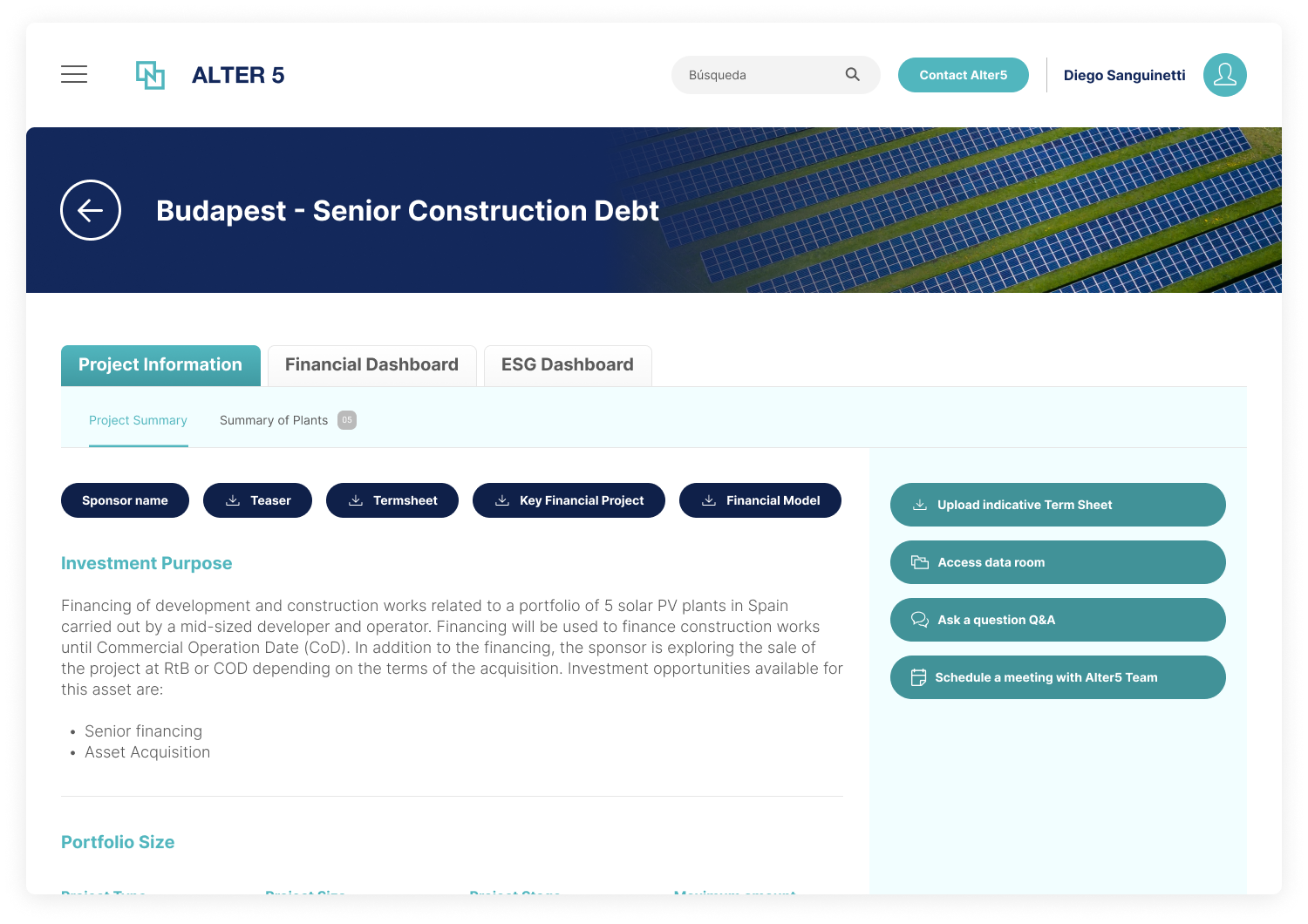

Alter5 permite a los promotores de proyectos de energía renovable acceder a soluciones de financiación y compraventa de proyectos de forma completamente digital, estandarizada y confidencial.

A través de Alter5, un promotor puede recibir una oferta de financiación o compra de su proyecto que se ajuste a sus necesidades. La plataforma también permite el acceso a un conjunto de proveedores de servicios (constructores, operadores de activos, asesores legales y técnicos, entre otros) previamente certificados y validados por Alter5.

- Sube tu proyecto

- Selecciona tu necesidad (financiación o venta)

- Obtén ofertas

- Cierra la transacción

Inversores

Alter5 permite a inversores de todo el mundo -fondos, aseguradoras, fondos de pensiones, gestoras de activos, compañías industriales, entre otros- acceder a un conjunto de proyectos de energía renovable.

Asimismo, a través del Programa de Emisión de Bonos Verdes de Alter5, los inversores institucionales que invierten en renta fija sostenible pueden acceder a distintos tipos de bonos con diferente rentabilidad-riesgo.

- Accede a proyecto previamente validados

- Oportunidades en deuda y equity

- Inversión directa o através de programas recurrentes

Modelo digital y financiero integrado

El modelo de Alter5 engloba dos elementos: una plataforma digital que facilita la originación, validación y la presentación a inversores de activos alternativos sostenibles y un vehículo de emisión de bonos verdes constituido en Luxemburgo que permite a los inversores estandarizar la operativa de inversión y utilizar una documentación única para todas las inversiones realizadas a través de la plataforma.

Originación

Originación

Originación

Originación

Activos son validados, seleccionados y estructurados

Oferta de activos institucionales

Plataforma de emisión de bonos verdes domiciliada en Luxemburgo

Oferta de bonos y acciones verdes

Alter5 Financial Technologies, S.L. en el marco del Programa ICEX Next, ha contado con el apoyo de ICEX y con la cofinanciación del fondo europeo FEDER. La finalidad de este apoyo es contribuir al desarrollo internacional de la empresa y de su entorno

Alter5 Financial Technologies, S.L. en el marco del Programa ICEX Next, ha contado con el apoyo de ICEX y con la cofinanciación del fondo europeo FEDER. La finalidad de este apoyo es contribuir al desarrollo internacional de la empresa y de su entorno